Media

The Very Group Funding plc announces an offer to purchase any and all of its outstanding 6.500% senior secured notes due 2026

May 15, 2025

The Very Group Funding plc (the “Offeror”), a direct wholly owned subsidiary of The Very Group Limited (the “Company” and, together with its subsidiaries, the “Group”), announces the launch of its offer to purchase for cash any and all of the 6.500% Senior Secured Notes due 2026 issued by the Offeror and guaranteed on a senior basis by the Company and certain of its subsidiaries (the “Existing Notes”), upon the terms and subject to the conditions set forth in the tender offer memorandum dated May 15, 2025 (the “Tender Offer Memorandum”), including, but not limited to, the New Financing Condition (as defined below) (the “Tender Offer”), which is available, subject to eligibility and registration, on the tender offer website (the “Tender Offer Website”): https://deals.is.kroll.com/theverygroup.

The Offeror is launching the Tender Offer as part of a proactive liability management exercise, which is expected to result in the extension of maturities of the Group’s capital structure.

Existing Notes purchased by the Offeror pursuant to the Tender Offer will be cancelled and will not be re-issued or re-sold. Tender Instructions will be irrevocable except in the limited circumstances described in the Tender Offer Memorandum.

Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Tender Offer Memorandum.

The Tender Offer will expire at 4:00 p.m., London time, on June 13, 2025, unless extended or earlier terminated (such time and date, as the same may be extended, re-opened, amended or terminated as provided in the Tender Offer Memorandum, the “Expiration Time”).

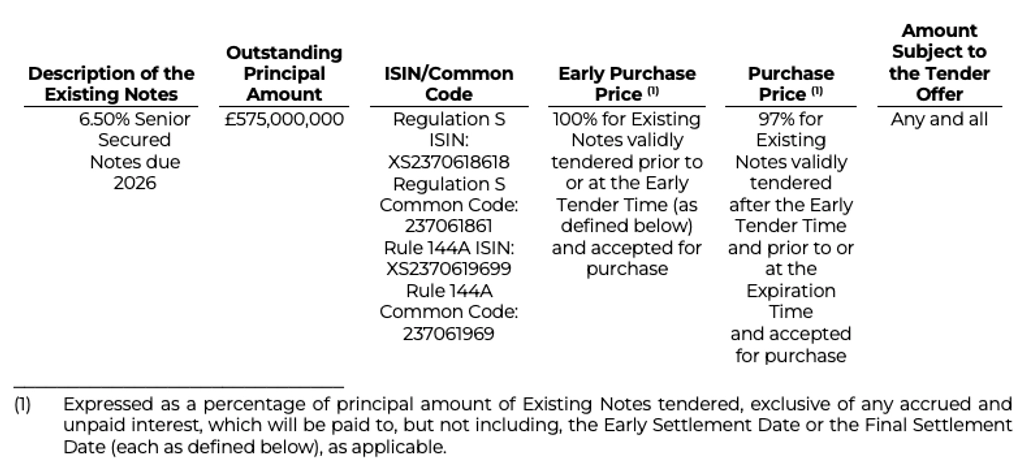

The following table sets forth certain details of the Tender Offer:

In addition to the Purchase Price, all holders of Existing Notes accepted for purchase will also receive accrued and unpaid interest on such Existing Notes, rounded to the nearest £0.01, with £0.005 rounded upwards, per £1,000 principal amount of Existing Notes, from and including the interest payment date immediately preceding the Early Settlement Date or the Final Settlement Date, as applicable, up to, but not including, the Early Settlement Date or the Final Settlement Date, as applicable (the “Accrued Interest Payment”). The Offeror announced on April 10, 2025 its intention to privately place (the “New Notes Private Placement”) new Senior Secured Notes due 2027 (the “New Notes”). It is expected that the issue of the New Notes will settle simultaneously with the settlement of the Tender Offer on on June 2, 2025 (the “Early Settlement Date”), subject to the right of the Offeror to extend, re-open, amend and/or terminate the Tender Offer.

Whether the Offeror will accept for purchase any Existing Notes validly tendered in the Tender Offer and complete the Tender Offer is subject, without limitation, to the successful completion (in the sole determination of the Offeror) of the issuance of the New Notes in an aggregate principal amount of at least £598,000,000 (the “New Financing Condition”). There can be no assurance that the Offeror will be able to satisfy the New Financing Condition. This announcement does not constitute an offer to sell or a solicitation of an offer to buy any New Notes. No assurances can be given that the Offeror will complete the New Notes Private Placement. The Tender Offer is conditioned upon, among other things, the successful completion (in the sole determination of the Offeror) of the New Notes Private Placement.

On or about August 1, 2025, the Offeror intends to redeem all Existing Notes not validly tendered by the Expiration Time and which remain outstanding following the date of the final settlement of the Tender Offer, currently anticipated to be June 17, 2025 (the “Final Settlement Date”) using the gross proceeds from the New Notes Private Placement, together with cash on hand of the Group. In connection with such redemption, it is expected that a portion of the proceeds of the New Notes will be deposited into one or more accounts of the trustee under the Existing Notes on or about the Early Settlement Date for purposes of satisfying and discharging the Offeror’s obligations under the indenture dated August 9, 2021 in relation to the Existing Notes (the “Existing Notes Indenture”). Any such redemption of the Existing Notes will be conditional upon the satisfaction or waiver of certain conditions, including completion of the New Notes Private Placement. This announcement does not constitute, and nothing herein contained shall be construed to constitute, a notice of redemption (whether conditional or otherwise) in relation to the Existing Notes.

Expected Timetable of Events

| Event | Expected Calendar Dates and Times | Description |

|---|---|---|

| Launch Date | May 15, 2025 | Launch of the Tender Offer. The Tender Offer Memorandum is made available to the holders of the Existing Notes through the Tender Agent (as defined below). |

| Early Tender Time | 4:00 p.m. London time on May 29, 2025 (unless extended in accordance with the terms of the Tender Offer Memorandum) | Deadline for receipt of valid tender instructions in order for the holders of the Existing Notes to settle their participation in the Tender Offer by the Early Settlement Date. |

| Early Results Announcement Date | As soon as reasonably practicable after the Early Tender Time | Announcement of (i) whether the Offeror will accept (subject to satisfaction or waiver of the New Financing Condition on or prior to the Early Settlement Date) valid tenders of Existing Notes tendered prior to or at the Early Tender Time for purchase pursuant to the Tender Offer and (ii) if so accepted, the aggregate principal amount of the Existing Notes accepted for purchase. |

| Early Settlement Date | June 2, 2025 (which is expected to be two Business Days after the Early Tender Time) | Subject to satisfaction or waiver of the New Financing Condition on or prior to such date, expected settlement date for holders of the Existing Notes who have validly submitted tender instructions by the Early Tender Time. |

| Expiration Time | 4:00 p.m. London time on June 13, 2025 (unless extended in accordance with the terms of the Tender Offer Memorandum) | Final deadline for receipt by the Tender Agent of valid tender instructions in order for holders of the Existing Notes to be able to participate in the Tender Offer. |

| Results Announcement Date | As soon as reasonably practicable after the Expiration Time | Announcement of (i) whether the Offeror will accept (subject to satisfaction or waiver of the New Financing Condition on or prior to the Early Settlement Date) valid tenders of Existing Notes tendered after the Early Tender Time and prior to or at the Expiration Time for purchase pursuant to the Tender Offer and (ii) if so accepted, the aggregate principal amount of the Existing Notes accepted for purchase. |

| Final Settlement Date | Following the Expiration Time, and we currently anticipate this date would be June 17, 2025 (which is expected to be two Business Days after the Expiration Time) | Subject to satisfaction or waiver of the New Financing Condition on or prior to the Early Settlement Date, expected Final Settlement Date for the Tender Offer. |

Noteholders are advised to check with any bank, securities broker or other intermediary through which they hold Existing Notes when such intermediary would need to receive instructions from a Noteholder in order for that Noteholder to be able to participate in, or (in the limited circumstances in which revocation is permitted) revoke its instruction to participate in, the Tender Offer before the deadlines specified above and in the Tender Offer Memorandum. The deadlines set by any such intermediary and each Clearing System for the submission of Tender Instructions will be earlier than the relevant deadlines specified above.

Subject to applicable law and the terms and conditions of the Tender Offer Memorandum, the Offeror may terminate the Tender Offer, waive any or all of the conditions of the Tender Offer prior to the Early Tender Time or the Expiration Time, extend the Early Tender Time and/or the Expiration Time or amend the terms of the Tender Offer.

None of the Offeror, the guarantors of the Existing Notes, J.P. Morgan Securities plc (the “Dealer Manager”), Kroll Issuer Services Limited (the “Tender Agent”) or the trustee (nor any director, officer, employee, agent or affiliate of, any such person) makes any recommendation whether noteholders should tender or refrain from tendering Existing Notes in the Tender Offer. Noteholders must make their own decision as to whether to tender Existing Notes and, if so, the principal amount of the Existing Notes to tender. Noteholders are urged to evaluate carefully all information in the Tender Offer Memorandum, consult their own investment and tax advisers and make their own decisions whether to tender Existing Notes in the Tender Offer, and, if so, the principal amount of Existing Notes to tender.

The Offeror has retained J.P. Morgan Securities plc to act as the Dealer Manager for the Tender Offer and Kroll Issuer Services Limited to act as Tender Agent for the Tender Offer. Questions regarding procedures for tendering Existing Notes may be directed to the Tender Agent at +44 20 7704 0880 or by email to [email protected]. Questions regarding the Tender Offer may be directed to J.P. Morgan Securities plc by email to [email protected] or at +44 20 7134 2468.

This announcement is for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any security. No offer, solicitation, or sale will be made in any jurisdiction in which such an offer, solicitation, or sale would be unlawful. The Tender Offer is only being made pursuant to the Tender Offer Memorandum. Holders of the Existing Notes are urged to carefully read the Tender Offer Memorandum before making any decision with respect to the Tender Offer.

The Tender Offer Memorandum has not be filed or reviewed by any U.S. federal or State or any foreign securities commission or regulatory authority, nor has any such commission or authority passed upon the accuracy or adequacy of the Tender Offer Memorandum. Any representation to the contrary is unlawful and may be a criminal offense.

The distribution of this announcement in certain jurisdictions may be restricted by law and therefore persons in such jurisdictions into which they are released, published or distributed, should inform themselves about, and observe, such restrictions. Any failure to comply with these restrictions may constitute a violation of the laws of any such jurisdiction.

***

Offer and Distribution Restrictions

United Kingdom

The communication of this announcement and any other documents or materials relating to the Tender Offer is not being made and such documents and/or materials have not been approved by an authorized person for the purposes of section 21 of the Financial Services and Markets Act 2000. Accordingly, this announcement and such documents and/or materials are not being distributed to, and must not be passed on to, persons in the United Kingdom other than (i) to those persons in the United Kingdom falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Financial Promotion Order”)), (ii) to those persons who are within Article 43(2) of the Financial Promotion Order, including existing members and creditors of the Offeror, (iii) to those persons who are outside the United Kingdom, or (iv) to any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order (all such persons together being referred to as “Relevant Persons”) and the transactions contemplated herein will be available only to, and engaged in only with, Relevant Persons. Any person who is not a Relevant Person should not act on or rely on this announcement or any of its contents.

France

This announcement and any other documents or offering materials relating to the Tender Offer may not be distributed in the Republic of France except to qualified investors as defined in Article 2(e) of Regulation (EU) 2017/1120, as amended.

None of this announcement or any other document or materials relating to the Tender Offer have been or will be submitted to the clearance procedures of the Commissione Nazionale per le Società e la Borsa (“CONSOB”) pursuant to Italian laws and regulations. The Tender Offer is being carried out in the Republic of Italy as an exempted offer pursuant to article 101-bis, paragraph 3-bis of the Legislative Decree No. 58 of 24 February 1998, as amended (the “Financial Services Act”) and article 35-bis, paragraph 3 of CONSOB Regulation No. 11971 of 14 May 1999, as amended (the “Issuers’ Regulation”). Accordingly, the Tender Offer is only addressed to holders of Existing Notes located in the Republic of Italy who are “qualified investors” (investitori qualificati) as defined pursuant to and within the meaning of Article 2(1)(e) of the Regulation (EU) 2017/1129 and article 34-ter, paragraph 1, letter b) of the Issuers’ Regulation. Holders or beneficial owners of the Existing Notes that are resident and/or located in the Republic of Italy can tender Existing Notes for purchase in the Tender Offer through authorized persons (such as investment firms, banks or financial intermediaries permitted to conduct such activities in the Republic of Italy in accordance with the Financial Services Act, CONSOB Regulation No. 20307 of 15 February 2018, as amended, and Legislative Decree No. 385 of 1 September 1993, as amended) and in compliance with any other applicable laws and regulations and with any requirements imposed by CONSOB and any other Italian authority.

Each intermediary must comply with the applicable laws and regulations concerning information duties vis-à-vis its clients in connection with the Existing Notes or the Tender Offer.

General

This announcement does not constitute an offer to buy or the solicitation of an offer to sell Existing Notes, and tenders of Existing Notes in the Tender Offer will not be accepted from holders of the Existing Notes, in any circumstances in which such offer or solicitation is unlawful. In those jurisdictions where the securities, blue sky or other laws require the Tender Offer to be made by a licensed broker or dealer and the Dealer Manager or any of its affiliates is such a licensed broker or dealer in any such jurisdiction, the Tender Offer shall be deemed to be made by the Dealer Manager or such affiliate, as the case may be, on behalf of the Offeror in such jurisdiction. The terms “affiliate” or “affiliates” when used in relation to the Dealer Manager shall have the meaning conferred to such term under Rule 501(b) of Regulation D under the United States Securities Act of 1933.

Certain statements included herein may constitute forward-looking statements within the meaning of the securities laws of certain jurisdictions. Certain such forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “are expected to”, “intends”, “will”, “will continue”, “should”, “would be”, “seeks”, “anticipates” or similar expressions or the negative thereof or other variations thereof or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this announcement and include statements regarding the intentions, beliefs or current expectations of the Offeror concerning, among other things, the results in relation to operations, financial condition, liquidity, prospects, growth and strategies of the Offeror and the industry in which it operates. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

These forward-looking statements speak only as of the date of this announcement. The Offeror does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required under Rule 14e-1 under the United States Securities Exchange Act of 1934.

Contact information

Investor enquiries

[email protected]

Notes to editors

About The Very Group

With annual revenue of over £2bn, The Very Group is a unique digital business that combines

online retail and flexible payments. Our digital retail brands, Very and Littlewoods, help to bring

over 2,000 desirable labels within easy reach of more customers.

Across electrical, home, fashion and more, we sell everything our 4.3 million customers could need,

except food. And our flexible payment options, which are provided responsibly via our Very Pay

platform and regulated by the Financial Conduct Authority, help our customers manage their

household budgets.

We have over a hundred years of history behind us, but at our heart there is a passion for change

– to constantly improve what we do, to innovate with data and technology at our core and to be

the best possible place to work.

For more information, follow us on LinkedIn and Instagram